Missed the ITR Due Date?

File now in < 30 mins.

4.9

(500+ Reviews)

3000+

Companies Formed

25+

Expert CA, CS & Lawyers

trusted by India's leading brands

Send data. Pay Tax online. And done!

We take care of everything else.

ITR Basic

For Salary, Rent & Interest Income Individuals

- Income Tax Return Filing

- One-on-one CA Consultation

- Get TDS Refund

- Basic Deductions

- Tax Planning for Optimising Tax Liability

₹ 1,499

Saves Rs. 1,500

ITR Premium

For Business & Simple Capital Gain Income Individuals

All Basic Plan Features +

- Business ITR Filing

- Preparation of Business Financials (Balance Sheet, P&L, Depreciation Schedule)

- Simple Capital Gains of Stocks & Bonds

₹ 3,499

Saves Rs. 2,500

ITR Advanced

For Complex Business Income & Capital Gains or Companies with a turnover > Rs. 5 crore

All Premium Plan Features +

- Complex Capital Gain/Loss

- Complex Business Income, Deductions

- Advance Tax & TDS Returns calculation & filing

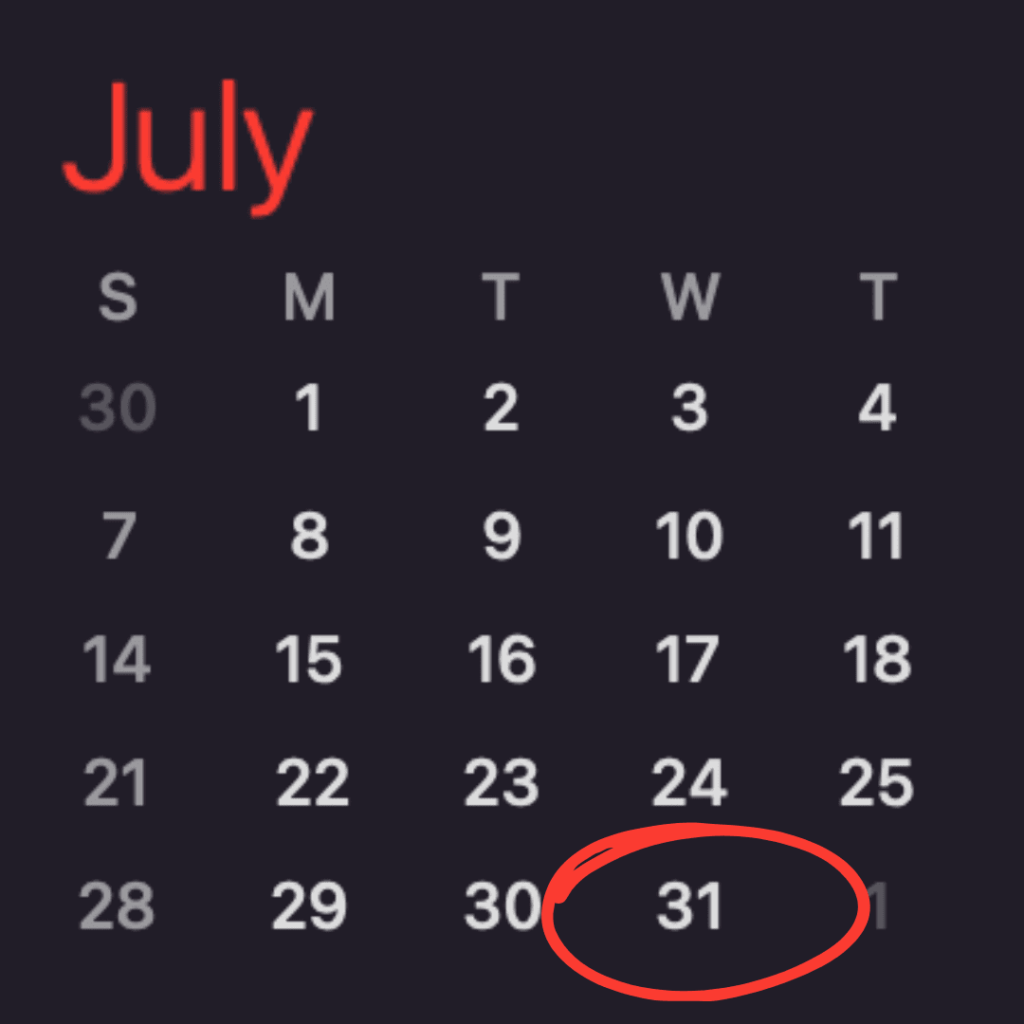

Income Tax Due Dates

- 00Days

- 00Hours

- 00Minutes

- 00Seconds

For Businesses not requiring Audit (Individuals, Partnership, HUF, AOP, BOI)

Late Fees:

If Income upto 5 lakhs – Rs. 1000 + Interest 12% p.a

If Income > 5 lakhs – Rs. 5000+ Interest 12% p.a

For Businesses requiring Audit (Companies, LLPs and other businesses if required to be audited)

Late Fees:

If Income upto 5 lakhs – Rs. 1000 + Interest 12% p.a

If Income > 5 lakhs – Rs. 5000+ Interest 12% p.a

Why CompanyExpress is the #1 choice for Income Tax Filings

100% Service Guarantee

If you're dissatisfied with our services for any reason, we have a 100% money back policy on our service fees.

Zero Late Fee Guarantee

We take due dates very seriously. If you miss a deadline due to non-timely reminder from our end, we will bear all of the late fee incurred.

Free 365 Days Expert Support

With our compliance services, you get access to our team of expert CA, CS and CFAs, who are available round the clock to guide you about your business related queries.

Frequently Asked Questions

Yes, you can claim an Income Tax Refund by filing a belated IT Return before 31st December, with Interest & Penalty.

Interest: at 1% per month

Penalty:

– Rs. 1000 (if income upto 5 lakhs)

– Rs. 5000 (if income > 5 lakhs)

Yes, you can file a return even if you miss the extended deadline of 31st Dec. However, you will have to pay a penalty of 25% to 50% of Tax due + Rs. 5000 as late fees.

You will also not be able to claim a TDS return or show a loss (may be possible with IT Officer permission but it is a much longer process).

Besides avoiding penalties, Income Tax Returns are useful for Loan Applications, VISA Applications, Obtaining credit cards, etc.

It also acts as a Income Proof which may be needed by some Employers or Customers.

There are many ways you could save thousands or even lakhs on your Income Tax Returns. These have to be planned and executed in advance before the Financial Year ends.

CompanyExpress is not just a platform for Tax Filing but we also proactively ensure you are using all of the tax saving tools available.

6 Easy Ways to Save tax:

- Form a HUF

- Invest Rs. 150000 every year in Tax Saving FD, Mutual Funds, ELSS, LIC Bonds, etc.

- Invest an additional Rs. 50000 in National Pension Scheme

- Buy Health Insurance for self and family and claim deduction upto Rs. 50000

- Take HRA as a part of Salary

- Invest in Post office savings bank deposits (Exempt upto Rs. 10000)

There are many other ways of saving taxes. Get in touch with us and we’ll provide you a comprehensive list along with step by step actions to save the most amount of tax based on your situation.

Employers provide Form 16 every year to their employees who receive salaries.

The document includes details regarding the employee’s income, tax-saving investments and deductions, and any tax deducted at source (TDS) for the relevant financial year. It is an essential document to submit your income tax returns.

Form 16 has two parts:

Part A – contains details about TDS deduction

Part B – contains a breakdown of the total tax paid.

It is mandatory for employers to provide Form 16 to employees who earn more than ₹2.5 lakh annually.

At CompanyExpress, we take it as our responsibility to remind you about filing deadlines. If we don’t remind you in advance and a late fee is incurred or if after receiving timely data we don’t file on time, we will bear 100% of the late fees. We usually remind our clients weeks or months in advance and multiple times before the due date. Our compliance clients have never paid a late fees due to non-reminder or a delay on our end.

Money saved is money earned!

*However, if we have reminded about the due date sufficiently in advance and the late fee is incurred due to business circumstances on the client’s part – we will not be bearing such late fees.

1) Free MS Office – We provide a Free Microsoft Office 2021 installation service on upto 2 computers. Additional computers can be activated at a nominal cost.

2) Shared Premium Hosting – We offer shared premium hosting with email and cloud backup from Hostinger to all compliance clients at a nominal cost of Rs. 800 per annum. We have a limit of sharing participants to ensure speed and sufficient bandwith.

3) Startup Assist – We help our clients access various government schemes for startups – such as tax holidays, low cost funding, promotion schemes, incubation, etc.

We also have partnerships with investors and banks to arrange funding for businesses on a case by case basis.

We help in preparing pitch decks, project reports and financial projections needed for such funding as well.