We ensure your business stays 100% compliant, while you focus on growth.

4.9

(500+ Reviews)

3000+

Companies Formed

25+

Expert CA, CS & Lawyers

trusted by India's leading brands

All your business compliances, in one place.

MCA Compliance

Auditing

GST Filings

IT Filings

Accounting

HR Compliance

CA Consultation

365 Support

Choose a plan that suits your needs

Compliance Starter

Includes:

- ALL MCA Compliances & Forms* Filing

- IT Filing

- Company Audit

- Digital Signature Certificate (DSC) Renewal

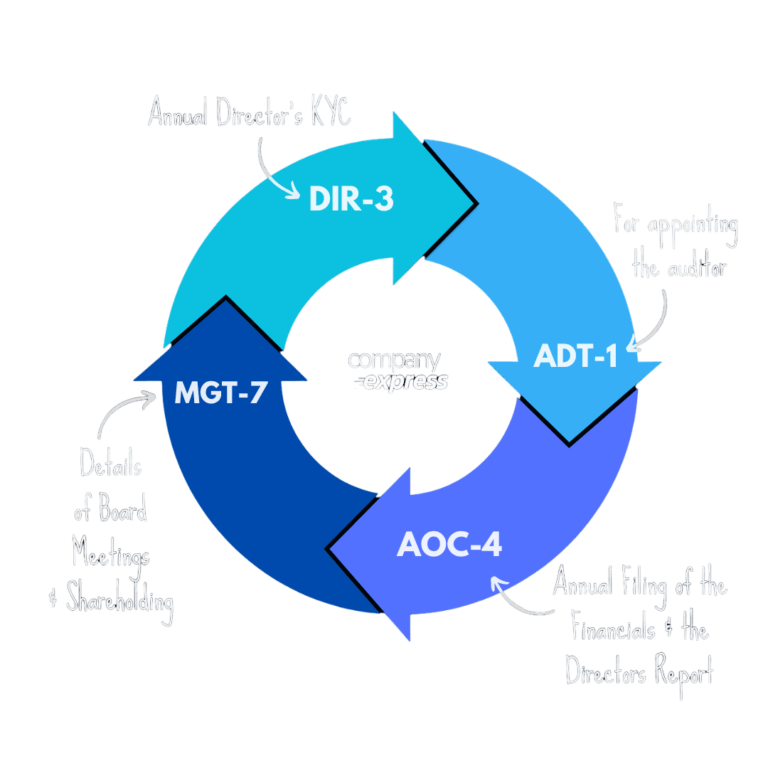

*MCA forms include all mandatory forms (such as AOC-4, MGT-7,

DIR-3 KYC, ADT-1) as well as any other forms to be filed as per MCA notification and business situations.

Rs. 20,999 /year

Saves Rs. 24,000 +

Compliance Pro ✨

Includes All Compliance Starter Features +

- GST Return Filing

- TDS Return Filing

- Provident Fund & ESIC

- Professional Tax Returns

*MCA forms include all mandatory forms (such as AOC-4, MGT-7,

DIR-3 KYC, ADT-1) as well as any other forms to be filed as per MCA notification and business situations.

Preferred Choice ⭐

Rs. 26,999 /year

Saves Rs. 45,000 +

No need to hire a dedicated accounts & payroll team. Our experts handle everything for you.

Better results. Big savings.

Compliance Elite

Includes ALL MCA Compliances & Forms* Filing, ITR Filing, Auditing & DSC Renewal +

- GST Return Filing

- TDS Return Filing

- Provident Fund & ESIC

- Professional Tax Returns

- Complete Accounting Services

- HR Compliance & Payroll Processing

Starts @ Rs. 99,999 /year

Saves Rs. 1,50,000 +

+ a world of attractive benefits

Why CompanyExpress is the #1 choice for compliances

100% Service Assurance

If you're dissatisfied with our services for any reason, we have a money back policy on our service fees.

Zero Late Fee Assurance

We take due dates very seriously. If you miss a deadline due to non-timely reminder from our end, we will bear all of the late fee incurred.

Ongoing Expert Support

With our compliance services, you get access to our team of expert CA, CS and CFAs to guide you about your business related queries.

Frequently Asked Questions

We will need accounting information as well as various company documents. All other details can be given through a simple questionnaire. For first time users, we’ll also need your user credentials for various government portals.

You are required to be compliant with all government regulations (like MCA, GST, ITR, TDS, Labour Laws, Licenses, etc) from the date of registration of your Company/LLP.

There may be a filing fee imposed by MCA on filing of each form. These are usually very nominal if filed on time.

We are the only legal services firm to offer Auditing services along with annual compliance. This is included if the Sales is below Rs. 3 crore in a FY.

Note: If your sales are above Rs. 3 crore, we decide the fees based on volume of work on a case by case basis. We DON’T LEVY EXTRA FEES if the volume of work is not substantially higher.

At CompanyExpress, we take it as our responsibility to remind you about filing deadlines. If we don’t remind you in advance and a late fee is incurred or if after receiving timely data we don’t file on time, we will bear 100% of the late fees. We usually remind our clients weeks or months in advance and multiple times before the due date. Our compliance clients have never paid a late fees due to non-reminder or a delay on our end.

Money saved is money earned!

*However, if we have reminded about the due date sufficiently in advance and the late fee is incurred due to business circumstances on the client’s part – we will not be bearing such late fees.

1) MS Office – We provide MS Office 2021 installation service on computers. Additional computers can be activated at a nominal cost.

2) Shared Premium Hosting – We offer shared premium hosting with email and cloud backup from Hostinger to all compliance clients at a nominal cost of Rs. 800 per annum. We have a limit of sharing participants to ensure speed and sufficient bandwith.

3) Startup Assist – We help our clients access various government schemes for startups – such as tax exemptions, low cost funding, promotion schemes, incubation, etc.

We also have partnerships with investors and banks to arrange funding for businesses on a case by case basis.

We help in preparing pitch decks, project reports and financial projections needed for such funding as well.

Company/LLP Forms Due Dates

Annual Company Compliance (MCA) - Companies

due date – Within 30 Days from AGM*

late fees – Rs. 20000 + Rs.300/day

*AGM is the Annual General Meeting to be held every year before 30th September.

due date – Within 60 Days from AGM*

late fees – Rs. 100/day

*AGM is the Annual General Meeting to be held every year before 30th September.

due date – 30th September

late fees – Rs. 5000

due date – Within 15 Days of Appointment of Auditor

late fees – Rs.400 to Rs. 7200

Annual Company Compliance (MCA) - LLP

due date – 30th May

late fees – Rs. 100/day

due date – 30th October

late fees – Rs. 5000