Get your GST Number in 7 working days

4.9

(500+ Reviews)

3000+

Companies Formed

25+

Expert CA, CS & Lawyers

trusted by India's leading brands

Need a GSTIN? Get it within 7 Days*.

*7 Working Days from the date of receipt of all required documents, subject to Aadhar Card of signatory being linked to mobile number. There may be unexpected delays from the GST Portal side but historically most applications get registered in 7 Days or less.

Express GST

7 days express GST enrollment for all forms of business.

- GST Certificate

- Help in determining GST Rate & Suitability

- FREE MSME

- GST Expert Consultation

Rs. 1,500

Saves Rs. 3000

FREE 3 Months GST Returns Filing worth Rs. 2400

Get the first 3 GST Returns for Free when you enroll GST with CompanyExpress. Save Rs. 2,400.

Also enjoy free GST Consultation to help you optimise your GST Liability.

Documents required for

GST Enrollment

For every owner/director/partner:

- PAN Card

- Aadhar Card

Proof of place of business:

- Lease/Ownership Deed or NOC

- Electricity Bill

Business Documents:

- Business PAN

- Certificate of Incorporation

- MOA & AOA (For Companies only)

Why CompanyExpress is the #1 choice for GST Registrations

100% Service Guarantee

If you're dissatisfied with our services for any reason, we have a 100% money back policy on our service fees. Most of our GST applications are approved within 7 days.

Free GST Registration

GST Registrations are completely FREE with Company Formation & GST Return Filing Services. GST Returns are mandatory and our GST services provide the best value.

GST Expert Consultation

With our GST services, you get a personal consultation with our GST experts to guide you on the type of GST registration suitable for you, GST rates, tax saving tips, etc.

Avoid GST Penalties &

Stay 100% GST Compliant

with CompanyExpress

GST Due Dates

Regular Scheme Dates

Due date (turnover > 1.5Cr) – 11th of next month

Due date (turnover < 1.5Cr) – 13th of next month

Late fees – NA

due date (regular) – 20th of next month

due date (QRMP*) – 22nd or 24th of next Month

late fees for non filing – Rs. 100/day

*QRMP is Quarterly Return Monthly Payment scheme for businesses with Turnover less than 1.5 crore.

due date – 31st December of subsequent FY

late fees – Rs. 50/day to Rs. 200/day

Composition Scheme Dates

due date – 18th of the month after end of quarter

late fees – Rs. 200/day

due date – 30th April of subsequent FY

late fees – Rs. 200/day

Pay GST at Lower Rate & Save Big with Composition Scheme

Beneficial for Businesses that have low value GST Purchases and/or sell to customers who are not registered in GST.

GST Rate:

1% – For Traders & Manufacturers

5% – For Restaurants

6% – For All Services

Benefits:

- Quarterly Return & simple Annual Return

- Lower rates of Tax

Eligible Businesses:

- Turnover < 1.5Cr for Goods (<50L for Services)

- ITC cannot be availed on Purchases

- Customer cannot claim GST credit

- Shouldn't be engaged in certain specified businesses**

Frequently Asked Questions

Registration under the GST Act is mandatory if your aggregate annual sales exceeds the threshold of 40 Lakhs for Goods Suppliers & Rs. 20 Lakhs for Service Providers*

*Exceptions:

- 10 Lakhs – Manipur, Mizoram, Tripura, Nagaland for both Goods & Services

- 20 Lakhs – For Telangana, Puducherry, Sikkim, Uttarakhand, Meghalaya, Arunachal Pradesh for both Goods & Services

Regardless of your turnover, registration is mandatory if –

1. You make Inter-State Supplies (eg. Sell goods from Delhi to UP)

2. You supply goods through an E-commerce portal (eg. Amazon)

3. You are a:

– Agent for Registered Principal

– Liable to Pay Reverse Charge

– Non-resident Taxable Person

– Casual Taxable Person

– Input Service Distributor

– TDS/TCS Deductor

– E-commerce Operator

– An online data access and retrieval service provider

Upon submitting a GST application, the details and place of business are verified by the GST Department.

Time taken for GST Certificate:

1. If the Aadhar Verification Successful – 7 working days from Date of Application

2. If Aadhar Verification fails or GST Officer deems it necessary to do site verification – 30 working days from Date of Application

GST registration online offers several benefits for businesses, including:

- Legitimacy: GST registration is a legal requirement for businesses with an annual turnover beyond a certain limit. Registering online not only ensures compliance but also assures legitimacy to the business.

Tax credit: GST registration enables businesses to claim tax credit on any purchases made for business purposes. This can provide significant cost savings for the business.

Allows businesses to carry out inter-state business operations

E-commerce Sales: Online sellers can sell on e-commerce portals with a GST Registration

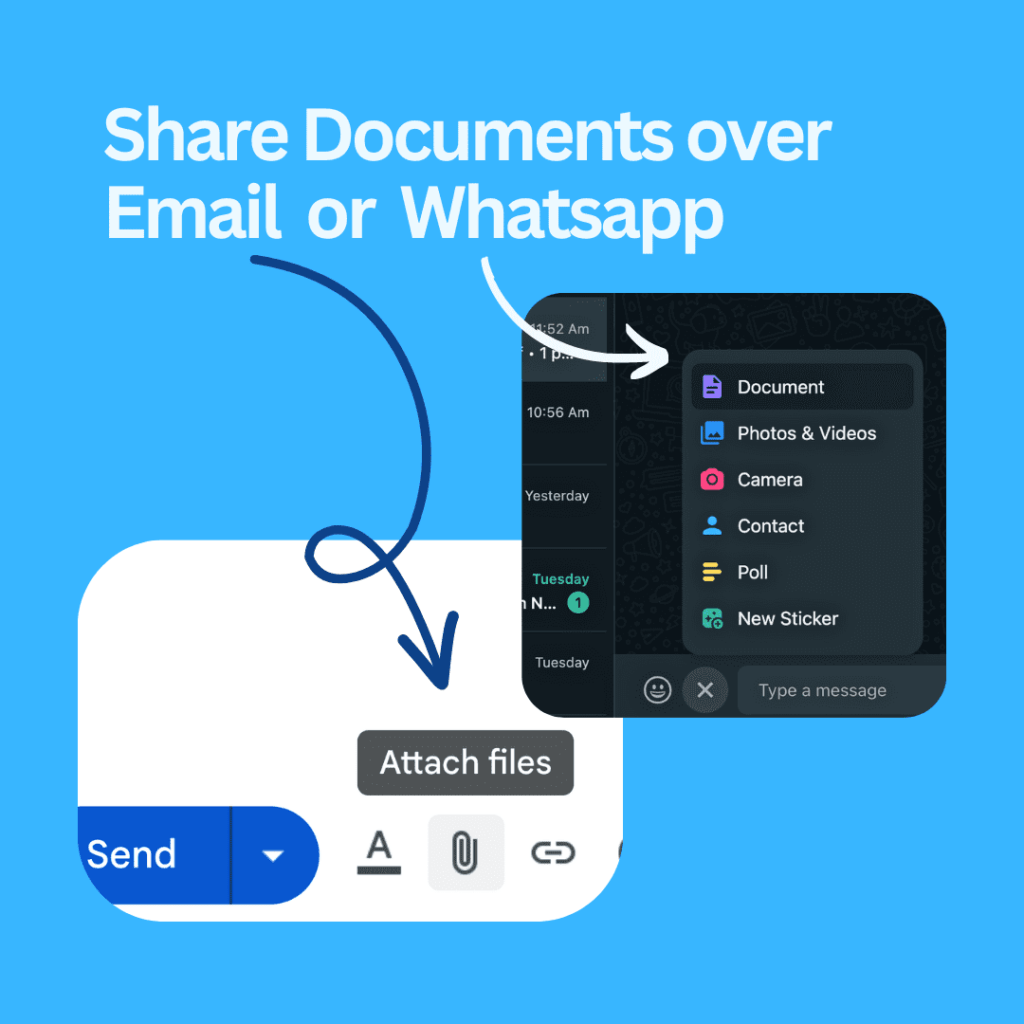

With CompanyExpress, GST Registration is a completely online process. Just scan and send us the required documents on Email or Whatsapp and we’ll prepare and file the application for you.

At CompanyExpress, we take it as our responsibility to remind you about filing deadlines. If we don’t remind you in advance and a late fee is incurred or if after receiving timely data we don’t file on time, we will bear 100% of the late fees. We usually remind our clients weeks or months in advance and multiple times before the due date. Our compliance clients have never paid a late fees due to non-reminder or a delay on our end.

Money saved is money earned!

*However, if we have reminded about the due date sufficiently in advance and the late fee is incurred due to business circumstances on the client’s part – we will not be bearing such late fees.

Get a GST Number for FREE when you sign up for GST Return Filing (Rs. 699 per month for minimum 3 months) or Company Formation with CompanyExpress.

GST Returns are mandatory to be filed every month. A good GST Advisor can save you thousands in taxes and penalties.

CompanyExpress ensures your GST returns are verified by expert CAs and offers the lowest prices for GST Returns Filing. The return filing fees is something you would pay anyways.

GST registration is absolutely free when you file GST Returns with CompanyExpress.